Hauser's law, the Laffer curve and pissed-off taxpayers

Can governments collect as much tax revenue as they they think they need simply by tweaking tax rates? Or was Arthur Laffer correct when he said that raising rates beyond a certain average level causes revenue to actually fall?

The debate over Laffer's theoretical insight hotted-up this week after the Wall Street Journal published a column by David Ranson touting economist Kurt Hauser's claim (Hauser's Law) that tax revenue sticks pretty close to 19.5% of GDP no matter where the government sets marginal tax rates.

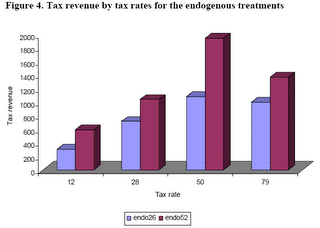

Fortunately, Hauser's take on the matter isn't the only one out there. A 2006 report (PDF) by Louis Levy-Garboua, David Masclet and Claude Montmarquette for Quebec's Centre Interuniversitaire de Recherche en Analyse des Organisations (CIRANO) looked at the behavior of individuals subject to varying tax rates. What they found is that the Laffer curve doesn't kick in when tax rates are perceived to be "exogenous" -- dispassionate and impersonal, like gravity. But when tax rates are experienced as unfair products of human calculation, the Laffer curve kicks in in spades.

The researchers conclude that "fiscal policies that serve macroeconomic purposes" are unlikely to trigger a revolt, but that "[i]n order to produce a Laffer effect, fiscal policies need to be felt as intentional, discriminatory and especially hurtful by a group of taxpayers."

The researchers conclude that "fiscal policies that serve macroeconomic purposes" are unlikely to trigger a revolt, but that "[i]n order to produce a Laffer effect, fiscal policies need to be felt as intentional, discriminatory and especially hurtful by a group of taxpayers."

So, if we can get God or Plato's philosopher-kings to take over tax policy, taxes might be raised nearly forever without consequence. But we live in a world in which taxes are inherently political, and tax rates are often used to reward or punish. Does anybody really experience changes in tax rates as dispassionate acts of nature? Or are they understood, more or less universally, as the arbitrary choices of whoever happens to be in power?

The currently popular craze to increase taxes on people considered wealthy is especially problematic since, say Levy-Garboua, Masclet and Montmarquette, "The initiators of tax revolts are usually found among the most productive, high-earning, and hard-working group of taxpayers." This point squares, of course, with Hauser's and Ranson's insight that "the capital controlled by our richest citizens is especially tax-intolerant." Try to soak the rich too much and, more than any other group, they'll skate their money out of the country, drop into the underground economy or stop being productive even if it hurts them to do so.

This, then, is likely why Hauser's Law seems to hold true. Taxpayers view tax rates as the outcomes of political decisions by human beings with axes to grind. Taxpayers will tolerate tax hikes up to a certain point -- but then, no more. In the modern-day United States, with expectations as they are, that has confined tax revenues in recent decades to roughly 19.5% of GDP.

The debate over Laffer's theoretical insight hotted-up this week after the Wall Street Journal published a column by David Ranson touting economist Kurt Hauser's claim (Hauser's Law) that tax revenue sticks pretty close to 19.5% of GDP no matter where the government sets marginal tax rates.

What makes Hauser's Law work? For supply-siders there is no mystery. As Mr. Hauser said: "Raising taxes encourages taxpayers to shift, hide and underreport income. . . . Higher taxes reduce the incentives to work, produce, invest and save, thereby dampening overall economic activity and job creation."Several tax-happy critics promptly set out to debunk Ranson and Hauser -- inadvertently reaffirming Hauser's Law in at least one case. But the biggest criticism of Hauser's Law seems to be the 100-mile-high view he takes of the economy. What's actually going on there and how can we know that it really prevents taxes from increasing as a share of the GDP?

Putting it a different way, capital migrates away from regimes in which it is treated harshly, and toward regimes in which it is free to be invested profitably and safely. In this regard, the capital controlled by our richest citizens is especially tax-intolerant.

Fortunately, Hauser's take on the matter isn't the only one out there. A 2006 report (PDF) by Louis Levy-Garboua, David Masclet and Claude Montmarquette for Quebec's Centre Interuniversitaire de Recherche en Analyse des Organisations (CIRANO) looked at the behavior of individuals subject to varying tax rates. What they found is that the Laffer curve doesn't kick in when tax rates are perceived to be "exogenous" -- dispassionate and impersonal, like gravity. But when tax rates are experienced as unfair products of human calculation, the Laffer curve kicks in in spades.

We do not observe the Laffer curve phenomenon in our simplified setting when tax rates are randomly imposed on working taxpayers. However, we observe it in a Leviathan state condition in which an experimental tax setter in flesh and blood is given the power to maximize tax rates to his own benefit. ...What constitutes "unfair" taxation? Whatever the taxpayers say it is. In the study, the maximum rate before revolt kicked in was 50% (this is a Canadian study, after all). Ultimately, though, it seems obvious that the trigger point will depend on the expectations of the specific taxpayers who are affected.

The fact that tax responsiveness of work is substantially greater when tax rates are set by another subject in flesh and blood than by nature is taken as evidence that workers respond strongly and emotionally to unfair taxation, which is consistent with the history of tax revolts. To be more specific, taxpayers want to punish the tax setters who intentionally violated the norm of fair taxation. ... We also find evidence of affective responses (Zajonc 1980) to unfair taxation by angry taxpayers who lost their temper and were ready to incur a net cost to hurt norm violators, and these turn out to be the ultimate cause for the Laffer curve phenomenon.

So, if we can get God or Plato's philosopher-kings to take over tax policy, taxes might be raised nearly forever without consequence. But we live in a world in which taxes are inherently political, and tax rates are often used to reward or punish. Does anybody really experience changes in tax rates as dispassionate acts of nature? Or are they understood, more or less universally, as the arbitrary choices of whoever happens to be in power?

The currently popular craze to increase taxes on people considered wealthy is especially problematic since, say Levy-Garboua, Masclet and Montmarquette, "The initiators of tax revolts are usually found among the most productive, high-earning, and hard-working group of taxpayers." This point squares, of course, with Hauser's and Ranson's insight that "the capital controlled by our richest citizens is especially tax-intolerant." Try to soak the rich too much and, more than any other group, they'll skate their money out of the country, drop into the underground economy or stop being productive even if it hurts them to do so.

This, then, is likely why Hauser's Law seems to hold true. Taxpayers view tax rates as the outcomes of political decisions by human beings with axes to grind. Taxpayers will tolerate tax hikes up to a certain point -- but then, no more. In the modern-day United States, with expectations as they are, that has confined tax revenues in recent decades to roughly 19.5% of GDP.

Labels: render unto Caesar

13 Comments:

With a 24x7 pundit cycle dedicated to convincing people that their taxes are unfair and being squandered, it seems vanishingly unlikely that anyone will regard taxes as "exogenous" ever again.

The main problem with the use of Hauser's chart is that the pundits (WSJ) are looking for the means to an end (lower taxes) and they'll selectively publish whatever supports that means.

For example, compare the top marginal rate to GDP itself. In the early 60s it dropped from 90% to 70%, however GDP growth remained mostly unchanged at ~2%. During the Reagan years, the rate dropped from 70% to 30%, GDP growth remained mostly unchanged at ~1%. Conversely, in the early 90s the rate rose 10%, but GDP growth -- you guessed it, stayed about 1% until the markets collapsed in Y2k due to bad investments and speculative excess.

So if Revenue as a % of GDP is invariant, sadly GDP is invariant as well -- which makes one wonder, just where are those dollars being invested?

Actually, the two data sets are complimentary -- yours and Hauser's. Hauser's figures suggest that the government is already collecting the highest percentage of the GDP in terms of revenue that Americans are currently willing to give up. Fiddling the rate doesn't change anything, because even the lowered rates are above the maximum the government will collect.

So the amount of money as a share of the economy in private hands doesn't change as the rates change. Leave aside for now the question over the effects of regulation and the distribution of taxes -- those affect GDP too, but they're beyond the scope of our conversation. The point is that rate changes over the years aren't changing the division of GDP between the government and the private sector, so the same amount of money remains in private hands to drive continued growth.

So where is that untaxed money going?

Much of it goes into the underground economy, most likely. The U.S. underground economy represents the equivalent of about 8.4% of GDP at the moment. That's about the smallest underground economy in the world, suggesting that other countries have even bigger problems with their versions of Hauser's Law.

Other dollars are distributed in legal ways that minimize their tax exposure but keep them part of the official economy. Still other dollars start off hidden but are then laundered back into the official economy.

The end result is an economy that's remarkably resistant to government manipulation.

Fair is and always has been a matter of opinion. As an average American, I don't care about percent of GDP, etc. All I care about is can I afford to live. If I have to work 2 hours to afford a blouse or baby diaper, something is wrong. Sorry folks, I do have 2 associate degrees and some skills. I am not a high school drop out. Is it time for the French Revolution. Did those people see enough blood. God I hope we don't get there.

This is total nonsense. Hauser's "Law" is ideological claptrap that is taught in no serious economic program.

Why? It restricts its analysis of taxation to the top income bracket, but it presents total government revenue. What happened in the period of 1950-2008 is that the top marginal rate generally went down, and the tax rates on everyone else generally went up. It is not surprising that overall revenues remained more-or-less flat, therefore. What happened was not some magical interference by the Invisible Hand, but a transfer of the tax burden from the very wealthy to the middle class. Not coincidentally, the middle class has been shrinking and real wages have been declining during the same period.

Hauser's Law joins the Laffer Curve* in the dustbin of right-wing voodoo economic theory. The only people who promote either are the people who, one way or another, benefit by doing so. Like those paragons of objective, scientific analysis at the WSJ editorial page.

*My favorite quote about the Laffer Curve came from my econ professor, who said "The Laffer Curve is relevant to policy in exactly the same way that the melting point of steel is relevant to washing the dishes."

Actually, the Laffer Curve has regained quite a lot of respect precisely because actual data now supports what was originally just a theory.

It sounds like your old econ professor could have used a lesson in ... well ... economics. Remedial economics.

I think you're misinterpreting the Ccon professor's comment. He wasn't saying that the Laffer Curve is completely discredited, he was saying that it only operates significantly at such extremes that it's irrelevant.

Has Hauser ever published his work for peer review? I haven't been able to find it.

One thing that Hauser seems to be saying unwittingly is that the wealthy do not contribute significantly to GDP. When the top tax rate rose and fell between 1950-2005 there was no significant impact on GDP. A more interesting analysis would be to look at the tax rate on the median income earner over that period.

The following statement from evidently lefty Annoymus, I meant Annonymous :) is not supported by data: "What happened in the period of 1950-2008 is that the top marginal rate generally went down, and the tax rates on everyone else generally went up. It is not surprising that overall revenues remained more-or-less flat, therefore. What happened was not some magical interference by the Invisible Hand, but a transfer of the tax burden from the very wealthy to the middle class. Not coincidentally, the middle class has been shrinking and real wages have been declining during the same period."

I beg to differ in my humble opinion supported by actual data: http://irs.gov/pub/irs-soi/05in05tr.xls.

The data doesn't reach as far as 1950, but IMHO is sufficient. In 1986 the top 1% of high-earners (not necessarily the rich) paid 25.75% of federal income tax revenue. In 2005 they paid 39.38%. In 1986 the top 10% of high-earners paid 54.69%, while in 2005 70.30% of all taxes.

Look at the data from IRS, and you'll see clearly transfer of tax burden from middle class to the high-earners.

However, the fact is that since the 1986 the share of AGI for 1% highest earners rose by about 100% (11.20% to 21.20%), while their share of tax revenue rose only about 50%. But, does it matter? They pay the bigger chunk of the tax revenue, so they deserve bigger breaks.

It does matter, "practical-investor." What you are failing to recognize is that the tax burden (gross burden, we must be careful to specify) increased on the wealthy, at the same time as income inequality was increasing. In other words, there was less middle-class income to support taxation, and there was more, much more, upper-class income to tax. Who else could then pay the taxes, other than the wealthy?

Their marginal tax rates did indeed fall in the 1960s, etc, as has been mentioned above. So they made a lot more money, and paid somewhat more taxes (not as much as their income increase). And GDP growth stayed about the same. So the benefits predicted by Hauser from reducing marginal tax rates didn't materialize.

The basic concept of the Laffer curve is that at a zero tax rate, the government will get no revenue, and at 100% tax rate, the government will get no revenue, because nobody will have any motivation to work. This is common sense. However, the Laffer curve is useless in practice, because nobody really knows where the maximum government revenue point is on the curve, or what shape the curve takes. It is impossible to observe empirically.

^^ nice blog!! ^@^

徵信, 徵信網, 徵信社, 徵信社, 徵信社, 徵信社, 感情挽回, 婚姻挽回, 挽回婚姻, 挽回感情, 徵信, 徵信社, 徵信, 徵信, 捉姦, 徵信公司, 通姦, 通姦罪, 抓姦, 抓猴, 捉猴, 捉姦, 監聽, 調查跟蹤, 反跟蹤, 外遇問題, 徵信, 捉姦, 女人徵信, 女子徵信, 外遇問題, 女子徵信, 徵信社, 外遇, 徵信公司, 徵信網, 外遇蒐證, 抓姦, 抓猴, 捉猴, 調查跟蹤, 反跟蹤, 感情挽回, 挽回感情, 婚姻挽回, 挽回婚姻, 外遇沖開, 抓姦, 女子徵信, 外遇蒐證, 外遇, 通姦, 通姦罪, 贍養費, 徵信, 徵信社, 抓姦, 徵信, 徵信公司, 徵信社, 徵信, 徵信公司, 徵信社, 徵信公司, 女人徵信, 外遇

徵信, 徵信網, 徵信社, 徵信網, 外遇, 徵信, 徵信社, 抓姦, 徵信, 女人徵信, 徵信社, 女人徵信社, 外遇, 抓姦, 徵信公司, 徵信社, 徵信社, 徵信社, 徵信社, 徵信社, 女人徵信社, 徵信社, 徵信, 徵信社, 徵信, 女子徵信社, 女子徵信社, 女子徵信社, 女子徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信,

徵信, 徵信社,徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 外遇, 抓姦, 離婚, 外遇,離婚,

外遇, 離婚, 外遇, 抓姦, 徵信, 外遇, 徵信,外遇, 抓姦, 征信, 徵信, 徵信社, 徵信, 徵信社, 徵信,徵信社, 徵信社, 徵信, 外遇, 抓姦, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信社, 徵信社, 徵信社,

Indeed, evry tax payer may have they're own indavidual Laffer curve and what is troubling is that many feel that they are already over the peak.

Each of us will attempt to maximize our indavidual utility function; talk of large marginal tax rate increases causes the pereived value of free time to rise and the perceived value of work time to decrease relatively.

In California, with 12% state tax rates on earners over 250K combined with federal tax rates, the line has been crossed in many minds; to maximize utility--work and risk less.

In many parts of California, 250K barely keeps the bills paid and classing this group as "rich" is ludicrous; people openly discuss relocating to other states or countries.

Actually the GDP has continually increased constantly from the 1890's all the way up to now. Here's a graph showing the trend

http://courses.umass.edu/ppol697d/growth.pdf

With regard to the laffe curve it's independent of Hauser's law because laffe's curve assumes a static number of people paying taxes at a certain rate. However, when tax rates have gone up or down, it has the effect of causing the economy to gain or lose jobs which throw off the laffe curve predictions thus making it unreliable.

Also it's important to understand that whenever you cut taxes across the board, the economy grows, jobs are created, and the GDP grows faster. Because of this increase, government gets more tax revenues because the percentage gained remains constant at 19.5 according to Hauser.

Here's more proof of Hauser's law at work, according to the CBO in 2003 total tax revenue gained by the government were 1.7 trillion dollars which averaged to 16.5 percent of the GDP and in 2006 tax revenues increased to 2.4 trillion dollars which averaged to 18.4 percent of the GDP. This is well within the predictions of the Hauser curve as the line does vary between 2 to 3 points but never the less proves once and for all that when you lower taxes, you increase the GDP the greatest and total tax revenues to the government.

Interesting series of comments. In order to create a more 'patriotic' playing field, I propose a flat tax system, with no exceptions and which taxes ALL income at the same rate, which, if Hauser makes any sense, would be about 19.5%

Although I personally agree that a flat tax is the fairest of all forms of taxation, it will never be adopted.

With a bracketed system, the IRS is free to alter the tax rates independently for each level annually, thus targeting those brackets they feel will be the must supportive of maximizing revenues. With this type of system, the controlling political party is able to use tax rates to curry favor with a particular income bracket, hence securing more votes from that income group. The Republicans tend to lower taxes for the wealthy, while the Democrats tend to raise taxes on the wealthy in order to lower them for the poor, and lower middle class.

With a flat tax system, all would feel the burden or relief equally as rates adjust up or down, and that wouldn't provide for much political capital to use against one's opponent.

It is really sad that our elected officials operate in this fashion.

Post a Comment

Links to this post:

Create a Link

<< Home