Arizona on the fiscal brink

Arizona's government seems to have painted its way into a corner with a bucket of red ink. Says the Phoenix Business Journal:

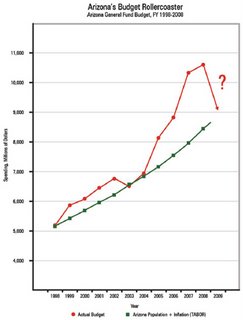

The problem, as usual, is that spending has been wildly out of control for the past several years, seriously outstripping growth in population and inflation.

As Tom Jenney, Director of the Arizona Federation of Taxpayers/Americans for Prosperity points out, "Arizona’s budget really got out of control in 2006 and 2007, when the size of state government as a portion of the state economy exceeded 6.5 percent—levels of spending not seen since the early 1990s."

The end result is that Governor Napolitano and her co-conspirators in the state legislature have seriously overcharged Arizona's figurative credit card.

Arizona actually has a spending limit of sorts, capped at 7.41% of state personal income. As the current situation demonstrates, however, our spending-mad representatives are perfectly capable of making plenty of mischief well before running afoul of that limit. Jenney's organization and the state GOP both support HCR 2038, legislation that would lower the spending cap to 6.4% of state personal income, a limit that would have actually made a difference in recent years (although it should be noted that Republican lawmakers were part of the spending problem). The cap could be lifted by a two-thirds vote -- a potentially dangerous provision, but probably a politically necessary one to satisfy the folks who believe the world will come to an end if the government isn't wallowing in stolen cash.

As it is, Arizona's government faces either massive budget cuts of the sort that make politicians squeal, or massive tax hikes bound to make taxpayers shriek. That may well provide further impetus for the growing movement to roll back property taxes (I signed the petition last month), if only to save some of our wallets' contents from the beast's maw.

It's better to limit spending now and avoid even nastier fights in the future.

Note: Thanks to AFT/AFP for the graph.

An analysis by the liberal Center for Budget & Policy Priorities shows Arizona with the worst budget deficit in terms of the shortfall's percentage of state spending.

Arizona's estimated $1.7 billion deficit is 16.2 percent of state spending, according to CBPP.

That is higher percentage than California (15.4 percent and a $16 billion deficit) and Nevada (7.8 percent and a $565 million deficit).

The problem, as usual, is that spending has been wildly out of control for the past several years, seriously outstripping growth in population and inflation.

As Tom Jenney, Director of the Arizona Federation of Taxpayers/Americans for Prosperity points out, "Arizona’s budget really got out of control in 2006 and 2007, when the size of state government as a portion of the state economy exceeded 6.5 percent—levels of spending not seen since the early 1990s."

The end result is that Governor Napolitano and her co-conspirators in the state legislature have seriously overcharged Arizona's figurative credit card.

Arizona actually has a spending limit of sorts, capped at 7.41% of state personal income. As the current situation demonstrates, however, our spending-mad representatives are perfectly capable of making plenty of mischief well before running afoul of that limit. Jenney's organization and the state GOP both support HCR 2038, legislation that would lower the spending cap to 6.4% of state personal income, a limit that would have actually made a difference in recent years (although it should be noted that Republican lawmakers were part of the spending problem). The cap could be lifted by a two-thirds vote -- a potentially dangerous provision, but probably a politically necessary one to satisfy the folks who believe the world will come to an end if the government isn't wallowing in stolen cash.

As it is, Arizona's government faces either massive budget cuts of the sort that make politicians squeal, or massive tax hikes bound to make taxpayers shriek. That may well provide further impetus for the growing movement to roll back property taxes (I signed the petition last month), if only to save some of our wallets' contents from the beast's maw.

It's better to limit spending now and avoid even nastier fights in the future.

Note: Thanks to AFT/AFP for the graph.

Labels: render unto Caesar, spending

2 Comments:

JD,

Arizona has backed itself into quite a mess. It has been spending rather than saving during the good times. Now that the real estate bubble has burst and the golden goose of property taxation can no longer be expected to fund government excesses government will have to make some long overdue changes.

Government spending must be reduced and local government must reduce property taxes accordingly, or the Arizona Tax Revolt initiatives will do it for them.

Please spread the word that for real property tax reform it is the Arizona Tax Revolt that has the property tax levy and valuation rollback initiatives. Learn more and volunteer on our WEB site at:

http://www.ArizonaTaxRevolt.org

You can download our Power Point presentation that shows the benefits of these measures and the problems with that other so called "Prop 13" measure that you had referred to in your article. The most significant problems with that measure are:

1) They do not tax improvements like for instance someone who builds a $1,000,000 home in 2004 or later on land they owned since prior to 2003.

2) They copied parts of California's famous Prop 13 measure but failed to provide the same taxpayer protections against non-ad valorem taxation. This means that taxes could just shift from those based on value, to for example a per-parcel tax with no net reduction in taxation and even substantial tax increases without voter approval as their .5% and 1% tax caps do not apply to non-ad valorem taxation.

Marc Goldstone, Chair.

Arizona Tax Revolt

Marc,

I wasn't aware that there are competing property tax initiatives. I'll definitely look into the matter and adjust my coverage accordingly.

Thanks for the heads-up!

Post a Comment

Links to this post:

Create a Link

<< Home