Martha's Vineyard: Case study of an underground economy

It's no secret that it's expensive and difficult to do business in Massachusetts. Taxes and regulations are onerous -- as of 2004, the Bay State was ranked 41 out of 50 on the Pacific Reserach Institute's Economic Freedom Index (full report here in PDF), which defines economic freedom as "the ability of an individual to allocate his resources according to his preferences without outside interference."

That has resulted in a bit of an exodus from the official economy into the shadow economy, where transactions are untaxed, unregulated (and unprotected by the force of law -- a tradeoff people are still willing to make to escape taxes and regulations). In response, the state has launched a crusade against underground economic activity, headed by a Joint Task Force on the Underground Economy and Employee Misclassification. The goal is to pull in some of the vast quantities of money that flow freely through the subterranean world, such as the estimated $152 million that is kept out of the hands of tax collectors each year simply by illegally classifying workers as independent contractors who then underreport their income.

That's the big picture. But what does the underground economy look like on a local level?

We can answer that question now, because a report (PDF) was recently released on the economy of Martha's Vineyard, an off-shore tourist mecca where, it turns out, the numbers just don't add up. It appears that there's a lot more economic activity than official figures allow for.

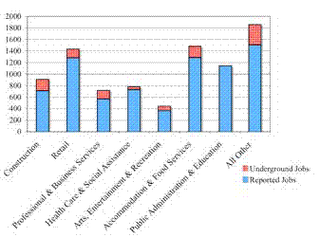

But how does that ultimately break down in terms of aboveground and underground activity? After looking at the figures, the report's author "estimates the underground economy on Martha’s Vineyard conservatively at 12 percent of reported wages and 16 percent of reported jobs. This represents at least 1,200 unreported jobs and $34 million in unreported wages. The actual numbers could be dramatically higher if the unsubstantiated estimate of 5,000 year-round undocumented foreign residents is close to accurate."

The off-the-books jobs appear to be fairly evenly distributed across the economy, with the logical exception of government positions. Basically, in every industry where it's possible to do so, a large chunk of the workforce is going about its business without paying taxes or worrying about red tape.

One of the interesting implications of these numbers is that people are better off than official numbers suggest, since they're earning far more from jobs, businesses and home rentals than is formally acknowledged.

And the the number of people working in the shadows is destined to grow since, as the report concedes, the underground economy is growing faster than its formal counterpart.

There are costs to underground work, of course. The report points to nebulous concerns about "community stability," but there are more serious problems when the fastest growing sector of the economy is one that enjoys no protection for contracts and no access to legal recourse in the courts.

But as long as governments impose high taxes and crippling regulations, some people -- growing ranks of them in fact -- will take their chances in the shadows.

That has resulted in a bit of an exodus from the official economy into the shadow economy, where transactions are untaxed, unregulated (and unprotected by the force of law -- a tradeoff people are still willing to make to escape taxes and regulations). In response, the state has launched a crusade against underground economic activity, headed by a Joint Task Force on the Underground Economy and Employee Misclassification. The goal is to pull in some of the vast quantities of money that flow freely through the subterranean world, such as the estimated $152 million that is kept out of the hands of tax collectors each year simply by illegally classifying workers as independent contractors who then underreport their income.

That's the big picture. But what does the underground economy look like on a local level?

We can answer that question now, because a report (PDF) was recently released on the economy of Martha's Vineyard, an off-shore tourist mecca where, it turns out, the numbers just don't add up. It appears that there's a lot more economic activity than official figures allow for.

Throughout most of the year, there are roughly 40 percent more employed residents than there are wagepaying local jobs. Given that relatively few workers commute off-island, this discrepancy suggests a high level of self-employment and a relatively high level of contract labor and unreported work.

But how does that ultimately break down in terms of aboveground and underground activity? After looking at the figures, the report's author "estimates the underground economy on Martha’s Vineyard conservatively at 12 percent of reported wages and 16 percent of reported jobs. This represents at least 1,200 unreported jobs and $34 million in unreported wages. The actual numbers could be dramatically higher if the unsubstantiated estimate of 5,000 year-round undocumented foreign residents is close to accurate."

The off-the-books jobs appear to be fairly evenly distributed across the economy, with the logical exception of government positions. Basically, in every industry where it's possible to do so, a large chunk of the workforce is going about its business without paying taxes or worrying about red tape.

One of the interesting implications of these numbers is that people are better off than official numbers suggest, since they're earning far more from jobs, businesses and home rentals than is formally acknowledged.

With the equivalent of at least 1,200 jobs and $34 million in wages, this conservative estimate of the island’s underground labor market is as large as the reported size of the Accommodation and Food Services or Retail industries. By comparison, the informal practice of renting one’s home on a weekly basis during the summer adds $60–$100 million/year in largely unreported income, much of which accrues to non-residents. The underground economy is directly linked to the perception that the island houses more residents than are officially reported. It also contributes to the sense that there is more money circulating, and that conditions for young adults and poorer residents may not be as bad as official reports indicate.

And the the number of people working in the shadows is destined to grow since, as the report concedes, the underground economy is growing faster than its formal counterpart.

There are costs to underground work, of course. The report points to nebulous concerns about "community stability," but there are more serious problems when the fastest growing sector of the economy is one that enjoys no protection for contracts and no access to legal recourse in the courts.

But as long as governments impose high taxes and crippling regulations, some people -- growing ranks of them in fact -- will take their chances in the shadows.

Labels: economic liberty, sock it to the state

1 Comments:

^^ nice blog!! ^@^

徵信, 徵信網, 徵信社, 徵信社, 徵信社, 徵信社, 感情挽回, 婚姻挽回, 挽回婚姻, 挽回感情, 徵信, 徵信社, 徵信, 徵信, 捉姦, 徵信公司, 通姦, 通姦罪, 抓姦, 抓猴, 捉猴, 捉姦, 監聽, 調查跟蹤, 反跟蹤, 外遇問題, 徵信, 捉姦, 女人徵信, 女子徵信, 外遇問題, 女子徵信, 徵信社, 外遇, 徵信公司, 徵信網, 外遇蒐證, 抓姦, 抓猴, 捉猴, 調查跟蹤, 反跟蹤, 感情挽回, 挽回感情, 婚姻挽回, 挽回婚姻, 外遇沖開, 抓姦, 女子徵信, 外遇蒐證, 外遇, 通姦, 通姦罪, 贍養費, 徵信, 徵信社, 抓姦, 徵信, 徵信公司, 徵信社, 徵信, 徵信公司, 徵信社, 徵信公司, 女人徵信, 外遇

徵信, 徵信網, 徵信社, 徵信網, 外遇, 徵信, 徵信社, 抓姦, 徵信, 女人徵信, 徵信社, 女人徵信社, 外遇, 抓姦, 徵信公司, 徵信社, 徵信社, 徵信社, 徵信社, 徵信社, 女人徵信社, 徵信社, 徵信, 徵信社, 徵信, 女子徵信社, 女子徵信社, 女子徵信社, 女子徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信,

徵信, 徵信社,徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 外遇, 抓姦, 離婚, 外遇,離婚,

外遇, 離婚, 外遇, 抓姦, 徵信, 外遇, 徵信,外遇, 抓姦, 征信, 徵信, 徵信社, 徵信, 徵信社, 徵信,徵信社, 徵信社, 徵信, 外遇, 抓姦, 徵信, 徵信社, 徵信, 徵信社, 徵信, 徵信社, 徵信社, 徵信社, 徵信社,

Post a Comment

Links to this post:

Create a Link

<< Home